Which is Best for Your Buy to Let: Personal Name or Limited Company?

Buy to Let: Personal or Limited Company?

Your home may be repossessed if you do not keep up repayments on your mortgage.

Most Buy to Let Mortgages are not regulated by the Financial Conduct Authority.

All information was accurate at the time of publication.

7th August 2024

In recent years, the buy-to-let landscape has undergone significant changes, with the emergence of limited companies as a popular investment vehicle. Traditionally, landlords acquired properties in their personal name. However, subsequent tax alterations have prompted many investors to consider forming limited companies to own their rental properties. This blog will delve into the reasons behind this shift, outlining the advantages and disadvantages of both ownership structures. We will also provide essential guidance on seeking professional advice and navigating the complexities of buy-to-let investments within a limited company or personal name.

What Is a Limited Company Buy-to-Let?

A limited company buy-to-let involves purchasing a property through a corporate entity rather than as an individual. While similar in many respects to a personally owned buy-to-let, this structure offers distinct advantages and considerations for landlords.

How Do I Compare Limited Company Buy-To-Let Mortgage Deals?

When considering property investment, engaging with a mortgage adviser such as myself, is highly recommended. Mortgage advisers can assess your financial circumstances and explore a wide range of mortgage options, providing tailored recommendations. While it's possible to approach a bank directly, this limits your choices to a single lender.

What Are The Advantages Of Buying A Buy To Let In My Personal Name?

Historically, buy-to-let properties were predominantly purchased in an individual's name. This ownership structure continues to be widely supported by lenders, with a greater selection of mortgage products available for personal buy-to-let investors compared to those purchasing through limited companies.

Due to increased competition for borrowers, buy-to-let mortgages held in personal names often present more favourable terms, including lower interest rates, reduced fees, and additional benefits such as free valuations or legal packages for remortgages. While these perks are not exclusive to personal ownership, they are generally more common.

What Are The Disadvantages Of Buying A Buy To Let In My Personal Name?

Tax implications are a significant factor when considering whether to purchase a buy-to-let property in your personal name or through a limited company. Rental income is subject to income tax, with higher-rate taxpayers facing rates of 40% or 45%. Given the complexities of property investment, seeking professional tax advice is strongly recommended. I can provide referrals to qualified tax advisers if required.

If the property is owned personally, Capital Gains Tax will be payable upon sale. Conversely, when held within a limited company, any profit from the sale is incorporated into the company's profit and loss account, with Corporation Tax due at the end of the financial year.

What Are The Advantages Of Buying A Buy To Let Through A Limited Company?

Owning a property through a limited company offers potential liability protection. Shareholders are generally liable only for the amount invested in the company. In the event of bankruptcy, personal assets are typically safeguarded.

Additionally, for higher-rate taxpayers, purchasing property through a limited company can often be more tax-efficient. Corporation tax rates are generally lower than income tax rates. Profits are taxed at the corporate level, rather than as personal income.

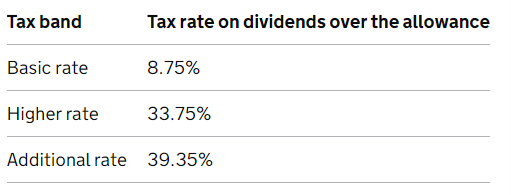

Extracting funds from the company is typically done through dividends. A small dividend allowance is available annually, after which dividends are taxed based on your personal income tax bracket.

Owning a Buy-to-Let property within a limited company can offer tax advantages over personal ownership. By incorporating, you can potentially reduce Inheritance Tax liabilities through strategic shareholder distribution, including family members. This structure also allows for reinvesting profits back into the business to purchase additional properties, further increasing its value. Unlike personal ownership, limited companies can claim finance costs such as mortgage interest as business expenses, offsetting rental income and reducing overall tax liability. It is essential to consult with a tax adviser to fully understand the implications and potential benefits of company ownership for your specific circumstances.

What Are The Disadvantages Of Buying A Buy To Let Through A Limited Company?

While purchasing a property through a limited company avoids Capital Gains Tax (CGT) upon sale, Corporation Tax is payable when profits are distributed. This means CGT reliefs, such as the £3,000 annual exemption for 2024/25, cannot be utilised.

Stamp Duty Land Tax (SDLT) is another consideration. Buying through a limited company incurs the additional 3% surcharge applicable to second homes.

Limited company Buy-to-Let (BTL) mortgages often come with higher interest rates and fees compared to personal mortgages due to the perceived increased risk for lenders. Moreover, the underwriting process is typically more stringent and time-consuming, as these loans often require senior underwriter approval.

To determine the most suitable option for your circumstances, I recommend speaking with myself so I can provide a personalised recommendation.

How Much Higher Are Rates For Limited Companies?

Using a simple comparison, The Mortgage Works currently offer Buy to Lets in your personal name, 5 year fixed rate at 3.84%, with a 3% fee, if you put down a 25% deposit.

By swapping this to a limited company, the rate increases to 4.99%. That’s an increase of 1.15%.

For a £200,000 mortgage on an interest only basis, the monthly payment will increase from £640.00 per month to £831.67 per month. Over the 5 years of the fixed rate, that’s a difference of £11,500.20

(£831.67 - £640.00 = £191.67. £191.67 x 60 months = £11,500.20)

Can I Create A New Limited Company To Purchase Property?

Establishing a new limited company to purchase an investment property is a straightforward process that can be completed online in approximately 15 minutes. By registering with Companies House at a cost of £12 or more, you can typically expect to receive company registration confirmation within 24 hours.

Do I Need A New Company For Each Buy To Let?

No, you can use the same company for multiples properties. There's no restriction on using the same lender for multiple Buy to Let mortgages. However, lenders often impose limits on the number of properties you can own or the total loan amount across your portfolio.

Some lenders may cap property ownership at ten or restrict the loan-to-value ratio to 75%. Additionally, they might require a rental cover ratio of 145% stressed at 5.5%. These terms can be complex, so please don't hesitate to ask if you need further clarification.

Can I Use My Current Company To Purchase A Buy To Let?

You can use your current company, but ideally the business will be set up as a Special Purpose Vehicle (SPV). When you register the proeprty on Companies house, they will give you a SIC code. Ideally they would be:

- 68100 – Buying & sell own real estate

- 68201 – Renting & operating of housing association real estate

- 68209 – Other letting & operating of own or leased real estate

- 68320 – Management of real estate on a fee or contract basis

If your limited company doesn’t have one of these SIC codes, you can change them.

If you don’t want to change the SIC code, you may still be able to get a mortgage, but you will have less options.

Can I Swap My Buy To Let From My Personal Name To A Limited Company?

If you swap your Buy to Let from your personal name to your limited company, then it is a change of ownership and it will be classed as a purchase. You can purchase a property from yourself via a limited company, but there are likely to be costs involved including stamp duty with the 3% premium.

Considering a property investment? Put your details in the form below and we can explore the potential benefits of both personal and limited company ownership. While I can provide comprehensive guidance on property and mortgage matters, tax advice is best sought from a qualified professional. If required, I am happy to recommend a suitable tax adviser. For the best results, it's advisable to initiate discussions early in the process to ensure you make informed decisions and benefit from my streamlined support.