Understanding Stamp Duty Changes Before the March 2025 Deadline

Understanding The Stamp Duty Changes

Your home may be repossessed if you do not keep up repayments on your mortgage.

Most Buy to Let Mortgages are not regulated by the Financial Conduct Authority.

The information contained within was correct at the time of publication but is subject to change.

13th November 2024

It’s been a week or two since the Autumn budget which brought some significant changes to stamp duty. In this blog we’re going to explore the changes and what you can do to reduce the amount of stamp duty you will pay and what happens if you don’t complete on your purchase before April 2025.

What has happened with stamp duty?

Here's a breakdown of the key stamp duty changes:

Pre-Pandemic Stamp Duty

Before the pandemic, standard stamp duty rates applied.

The Stamp Duty Holiday (2020-2021)

To boost the housing market during the pandemic, the government introduced a stamp duty holiday. This meant:

No stamp duty on the first £500,000 of a property's value.

First-time buyers could purchase homes up to £300,000 without paying stamp duty.

Post-Holiday Changes (October 2021)

Following the holiday, the rules returned to a modified version:

First-time buyers could still purchase homes up to £300,000 without paying stamp duty, but they would pay 5% on the portion between £300,000 and £500,000.

Standard rates applied for other buyers.

The 2022 Mini-Budget Changes (September 2022)

Kwasi Kwarteng's mini-budget introduced further changes:

No stamp duty on the first £250,000 of a property's value.

Reduced rates on the portion between £250,000 and £925,000.

First-time buyers could purchase homes up to £425,000 without paying stamp duty.

Please note: These changes were short-lived and have since reverted. It's essential to consult the latest HMRC guidelines for the most accurate information.

If you have specific questions about your property purchase, it's advisable to seek advice from a qualified professional.

What is changing with stamp duty in 2025?

In September, Chancellor Rachel Reeves produced Labour’s first budget since 2010. From the 1st April 2025, the government will be rolling back the stamp duty changes introduced in 2022. This means that non-first-time buyers will once again have to pay stamp duty on property purchases over £125,000.

How much more will I have to pay in stamp duty in 2025?

If you have already owned property previously, and you are moving to a home that is valued more than £250,000 the extra stamp duty will be £2,500.

As an example, if you were buying a £500,000 property, the stamp duty will increase from £12,500 to £15,000.

If you are a First Time Buyer, the initial threshold will reduce from £425,000 to £300,000 and the additional relief will reduce from £625,000 to £500,000.

As an example, if you were buying a £500,000 property, the stamp duty will increase from £3,750 to £10,000. This means completing on the purchase before the 31st March 2025 could save you £6,250.

Another example, if you were buying a £625,000 property, the stamp duty will increase from £10,000 to £21,250. This means completing on the purchase before the 31st March 2025 could save you £11,250.

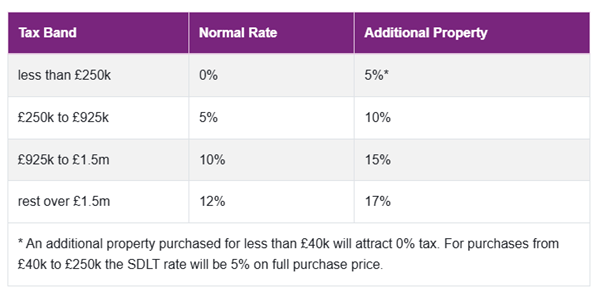

What are the current stamp duty thresholds?

If you have already owned property, the current tax thresholds are:

For First Time Buyers, you will not pay stamp duty on purchases below £425,000.

Between £425,001 and £625,000 you will pay 5%.

If you buy for more than £625,000, you won’t pay stamp duty up to £250,000 and between £250,000 and £925,000 you will pay 5%.

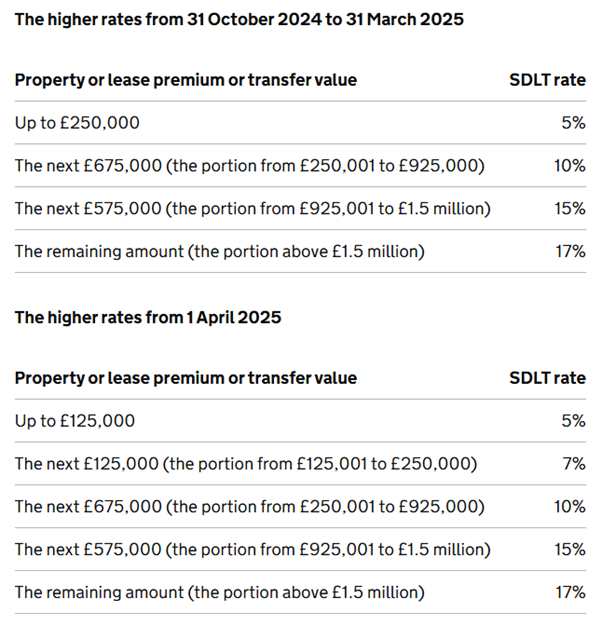

What will the stamp duty threshold be from April 2025?

From the 1st April 2025, stamp duty will revert back to pre-September 2022 levels.

This means that for first time buyers the lower threshold will reduce from £425,000 to £300,000 and any property over £500,000 will be subject to the same stamp duty as next time buyers.

For people who’ve owned property previously, you will pay 2% stamp duty between £125,000 and £250,000 and 5% between £250,001 and £925,000.

How will the stamp duty changes impact First Time Buyers?

The impending stamp duty changes will significantly impact first-time buyers. As the March 2025 deadline looms, a surge in property transactions is expected, putting immense pressure on conveyancing services. This increased demand could lead to longer processing times and potential delays in completing property purchases.

Moreover, the higher stamp duty rates after April 2025 will necessitate increased upfront costs. This could result in smaller deposits, higher interest rates on larger loan-to-value mortgages, increased monthly repayments, or extended mortgage terms. Ultimately, these factors could impact long-term financial planning and retirement goals.

How will the stamp duty changes impact home movers?

The impact of these changes will extend to home movers as well. Completing a property purchase before the March 2025 deadline will be crucial to avoid increased stamp duty costs.

Should buyers be unable to finalise their purchases before April 1st, the added expense of stamp duty could lead to deals falling through and entire property chains collapsing. Additionally, some sellers might capitalise on the situation by increasing their asking prices closer to the deadline, knowing that buyers may be willing to pay a premium to secure the property before the stamp duty hike.

What's happening to stamp duty for second homes and Buy to Let properties?

The recent Autumn Budget brought some unwelcome news for property buyers, especially those purchasing additional homes or second properties.

From 31st October 2024, the additional stamp duty surcharge for second homes and buy-to-let properties increased from 3% to 5%. This sudden change caught many off guard, including one of my clients who had to find an extra £15,000 for their £750,000 property purchase.

Furthermore, the government announced changes to the standard stamp duty rates, which will come into effect on 1st April 2025. The current £250,000 threshold for the 0% band will be reduced to £125,000. Additionally, the 5% band will apply to the next £125,000, with a higher rate of 7% kicking in thereafter.

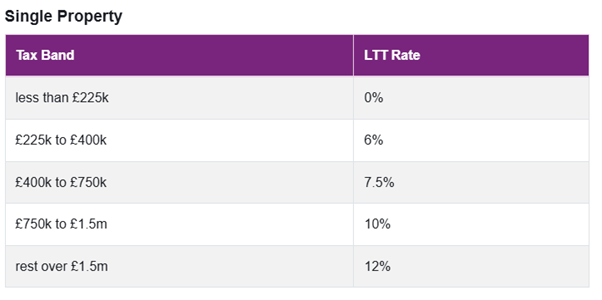

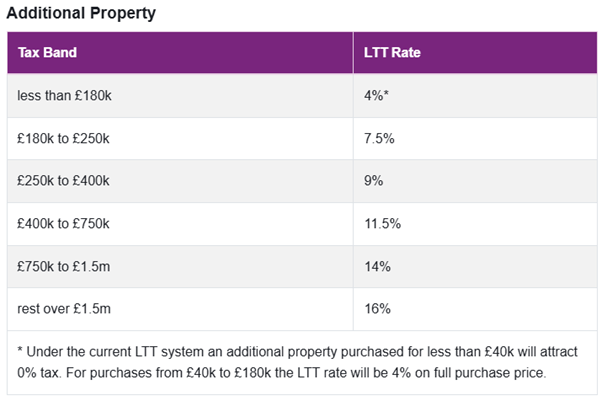

What is the land transaction tax in Wales?

In Wales, stamp duty has been replaced by Land Transaction Tax (LTT). It’s similar to stamp duty, but has different thresholds.

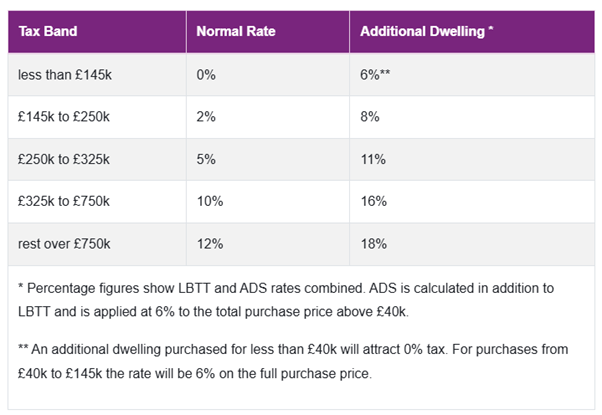

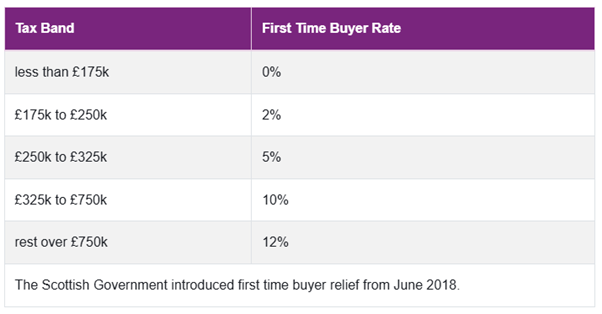

What is the land and buildings transaction tax in Scotland?

In Scotland, stamp duty has been replaced by Land and Buildings Transaction Tax (LBTT). It’s similar to stamp duty, but has different thresholds.

What are the best tips for saving money on stamp duty?

To maximise your savings on stamp duty, it's crucial to complete your property purchase before the 31st March 2025. To ensure a smooth process, consider working with a reputable local conveyancer. Local firms often provide more personalised service compared to larger national companies. If you need a recommendation, don't hesitate to ask.

Additionally, partnering with a reliable lender can expedite the mortgage approval process. This can help you avoid delays and ensure a timely completion. I will recommend a lender who can offer quick approvals and competitive rates.

What are the risks if you don't complete on your purchase before the stamp duty changes in April 2025?

The upcoming stamp duty changes will undoubtedly impact the property market. Here are some key points to consider:

Increased Stamp Duty Costs:

Higher Expenses: Buyers who complete their purchases after April 1st, 2025, will face increased stamp duty costs.

Potential Chain Disruptions: This could lead to property chain breakdowns, as buyers may struggle to afford the additional costs.

Price Inflation: Sellers may capitalise on the situation by increasing their asking prices closer to the deadline, knowing that buyers might be willing to pay a premium to avoid higher stamp duty.

Market Volatility:

Shifts in Property Values: The change in the £625,000 stamp duty threshold might lead to price fluctuations for properties in this price range.

Increased Uncertainty: The overall uncertainty in the market can lead to higher costs for various services, including mortgages, conveyancing, surveys, and estate agent fees.