Stepping Onto the Property Ladder: Shared Ownership, Shared Equity, and First Homes Schemes

Your home may be repossessed if you do not keep up repayments on your mortgage.

All information was accurate at the time of publication.

31st July 2024

Dreaming of owning your own home but feeling overwhelmed by soaring property prices? You're not alone. Many first-time buyers, like one of our recent clients, find themselves facing similar challenges. With a strong desire to settle back in Bristol and a healthy deposit saved, they were eager to climb the property ladder. However, the reality of the market made their dream home seem out of reach.

Sound familiar? If you're exploring your options for homeownership, you've likely come across terms like shared ownership, shared equity, and the First Homes scheme. In this blog post, we'll break down these schemes and help you understand how they can be a stepping stone to your dream home.

What is Shared Ownership?

Shared Ownership is a fantastic way for many people to get on the property ladder. This scheme involves purchasing a share of a property from a housing association. You then pay rent on the remaining share that the association owns. The percentage of ownership can vary, allowing you to choose an option that suits your budget. As you become financially able, you may have the opportunity to purchase additional shares in your home, gradually increasing your ownership stake. It’s important to note that when you eventually sell the property, the housing association will retain their share of the profit.

How is shared ownership rent calculated?

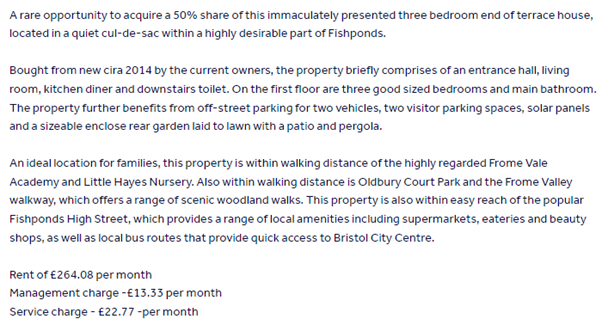

The rent charged will vary from property to property.

When you’re searching on Rightmove or Zoopla, you can click on filters and search by Buying Schemes. This will bring up all of the properties which are shared ownership. When you click on the properties, it will usually tell you if it’s a 50% share, or 75% share etc.

Not all listings will give you the rental figures, and they’ll want you to call the estate agent to find out, but a lot of them do:

How do the banks and building societies calculate the affordability for shared ownership?

It's important to note that not all lenders offer support for shared ownership. While some, like NatWest, can help with shared equity, they may not provide options for shared ownership. To ensure you have the best possible choices, it's advisable to discuss your plans with a myself before making an offer on a property.

Many major lenders do offer shared ownership mortgages. When using their affordability calculators, you'll typically be asked for the property's full value, the share you're purchasing, and your desired mortgage amount. Based on this information, they can calculate your potential borrowing limit. Alternatively, some lenders may factor in your rent as part of their affordability assessment.

What requirements do the lenders have around shared ownership?

Securing a mortgage for a shared ownership property involves specific criteria. Lenders consider factors such as the property's lease length, ground rent, and service charges. It's essential to purchase at least a 25% share, with a maximum of 75%.

One of the key benefits is the low deposit requirement. Typically, just a 5% deposit is needed on your share. For example, if you purchase a 25% share of a £400,000 property, you'd only need a £5,000 deposit. This makes shared ownership an attractive option for those looking to step onto the property ladder.

To fully own your home, you'll need the option to 'staircase'. This means buying additional shares over time. As your financial circumstances improve, you may be able to purchase the remaining shares from the housing association.

What are the benefits of shared ownership?

The biggest benefit with all of these schemes is that it will allow you to purchase a property you might not have otherwise been able to afford. With shared ownership, because you can staircase to 100%, over time, you can buy further shares of the property and eventually you might be able to own 100% of the property.

What are the negatives of shared ownership?

Some people don’t like shared ownership because you are still paying rent, despite owning a part of the property. The housing association also benefits from an increase in property value. If you buy a £200,000 property with a 50% share = £100,000, but you sell it in the future for £250,000, your 50% share is now £125,000 and the housing association’s share is £125,000. They’ve made a profit of £25,000 off your home improvements and property appreciation, on top of receiving a rent.

Another issue with all of these buying schemes is that they are few and far between. You may have to compromise on the location of the property, and you may have to compromise on the actual property you are looking to purchase too.

What is shared equity?

Shared Equity is almost identical to shared ownership, with the one exception being that you don’t pay rent on this scheme. This means that the housing association just owns a percentage and when you sell the property they will make their profit from the increase in property value.

While writing this blog I had a look for shared equity properties in Bristol and there aren’t any for sale currently. Widening my search, the first shared equity property was in Blackwood, which is 15 to 20 miles north of Cardiff and Newport.

This particular property was valued at £171,500 for a 70% share. This means that the full value is roughly £245,000:

Shared Equity

This home is available on the Homebuy shared equity scheme allowing you to purchase at £171,500 which is 70% of the full value. The remaining 30% is funded via an equity loan which you are not required to pay any rent or interest on.

What is the First Homes Scheme?

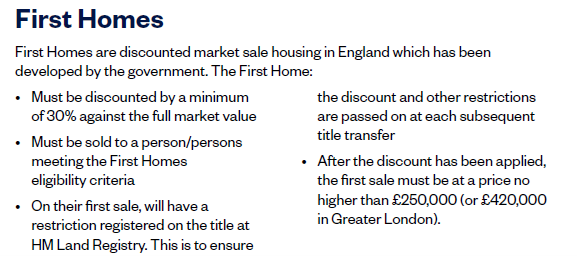

The First Home Scheme was the scheme my new client was most interested in. They’d read that you could purchase a property for between 30% to 50% less than its market value. I reached out to Nationwide who are one of the lenders who can help with First Homes and they had the following information:

What are the benefits of the First Homes scheme?

The obvious answer is that you are able to purchase a property for significantly less than its full value. There’s no rent to pay like shared ownership and it’s more widely available than shared equity.

What are the benefits of the First Homes scheme?

On the government website it lists:

You must:

- be 18 or older

- be a first-time buyer

- be able to get a mortgage for at least half the price of the home

- not earn more than £80,000 a year before tax (£90,000 if the property is in London) - this is your income from the previous tax year

If you're buying with others:

- you must all be first-time buyers

- you must apply together, even if you’re not all getting a mortgage

- your joint income cannot be more than £80,000 a year before tax (£90,000 if the property is in London)

Your joint income is the total of what you all earned in the previous tax year.

Local councils might also give priority to key workers or people who already live in the area, or people on lower incomes.

What are the negatives of the First Home Scheme?

As with the shared equity and shared ownership schemes, the properties themselves are few and far between.

The process is a little long winded too. You need to speak with the developer or estate agent who will check you meet the above criteria, they will then apply to the local council on your behalf. Once the application is successful, it’s the usual route for purchasing a property.

Do have a read of this blog for first time buyers: 10 Questions for First Time Buyers

Another negative is that when you come to sell the property, it has to be sold to another person looking to use the First Home Scheme. This might mean that there are less people looking to purchase your property than if you bought without the First Home Scheme.

If you’re looking to purchase a property using shared ownership, shared equity or the first homes scheme, do get in touch to see how I can guide you through your home buying experience.